In which I pick up where Michael Lewis’s fascinating, new book Flash Boys leaves off

You start to follow the money, and you don’t know where the fuck it’s gonna take you.

-Det. Lester Freamon

In Montreal in the fall of 2007, a former journalism student of mine asked if I would serve as a reference for him. He hoped to be hired for what had in recent years become a rarity, a well-paid, entry-level journalism job. The position was at a local organization that I had never heard of and whose name is so very boring that I fear if I tell it to you, you may stop reading before my story has even begun.

So please consider before I reveal the name in question that it might have been picked not in spite of its boringness but precisely because of it. If you wanted to fly under the radar in the world’s financial and media capitals, could there be any better way to do so than as a representative of the Canadian Economic Press or CEP News for short?

Whether that utterly unsexy name was a stroke of inspired genius or sheer dumb luck, I will likely never know, but what I can tell you is that Canadian Economic Press was just one of several strange “news agencies” that I later discovered were tied to the secretive world of high frequency trading or HFT as it’s known. Along the way I also encountered many of the same things Michael Lewis did in Flash Boys : bumbling FBI agents, clueless government regulators and employees who didn’t know what the firms they worked for really did. Just like Flash Boys does, my HFT story ends with a microwave tower.

All of this happened because, as someone who is interested in the future of the troubled news industry, I was curious to find out how exactly how Canadian Economic Press planned to make money and who the people behind it were. The explanations provided by its marketing director, Paula Midena, made no sense to me. She said that CEP News had been founded to report on global economic news from a Canadian perspective, not a product for which there’s a booming market, and that the man in charge was Darren Corbett while the “original investor,” was Canadian Venture Media Corporation, neither of whom had profiles either on the internet or in various research-worthy databases.

Since Midena couldn’t or wouldn’t tell me more and no one else at Canadian Economic Press was available to talk, I posted the information I’d obtained on my blog and hoped that someone who knew about the situation would eventually find me and fill me in. The strategy worked and over the next few months I learned from anonymous commenters that Canadian Economic Press had suddenly shut down its Washington operations, that I should check out the D.C.-based Need To Know News (NTKN) agency, which had been started by Chicago traders and bore a strong resemblance to Canadian Economic Press, and that, according to a commenter using the name Tdot: “There’s tons of these news startups with bad business models. Here’s another one that’s hilarious, World Business Press (WBP Online) – Slovakian newswire, with an office in Canada, releases Canadian economic news… in English. How much demand can there be for that in Slovakia?”

Puzzled as I’d been by the advent of Canadian Economic Press, it was even more perplexing to learn that it was not alone. Beyond their acronymous names, CEP News, NTKN and WBP Online had a lot of other characteristics in common: very basic websites, mediocre news feeds, little to no information about who owned or ran the companies, and lots of young inexperienced reporters, almost none of whom seemed interested in how their employers were making money at a time when many traditional media companies were in deep financial trouble.

Once in a while, however, one of these employees would get curious, go rogue and send me an email. “At CEP, staff welfare goes to a whole new level,” wrote a journalist, whose Spidey senses were tingling. “Not only do you have free coffee, tea, juice and bottled water – there are fruitcakes, cupcakes, bread, cereal, cereal and fibre bars to go with it. Thats the breakfast sorted. Then every Friday – the ENTIRE Montreal staff (we’re looking at 25-30 people) get meals of their choice catered to the office all paid for by the company. The evening is rounded off at the Keg, a couple of streets from the Montreal HQ. Extraordinary isn’t it?”

Indeed it was and especially given the fact that CEP news had told the Canadian embassy in Washington that it had decided to close its D.C. bureau due to its investor pulling out. Determined to get to the bottom of the situation, I spent evening after evening on my laptop, glass of wine in hand, as I surfed the websites of forex trading companies registered in Cyprus and Belize, stalked the LinkedIn profiles of Montreal investment managers, and tried to decipher both Slovak company registration documents and the incomprehensible language on the websites of Chicago-based proprietary trading companies otherwise known as prop shops. On a few memorable occasions I thought I’d discovered the key to it all, but when I awoke the mornings after I quickly realized my theories made no sense. By the time CEP News folded in April of 2009, I still hadn’t figured out what was going on and was starting to doubt that I ever would.

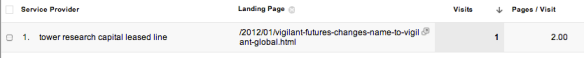

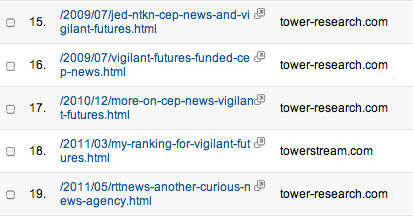

It was in one of my dark moments that the email I’d been waiting for for almost a year and a half arrived. It was from a trader who, though he did not wish to be named, was prepared to reveal his identity, unlike almost everyone else. He informed me that Canadian Economic Press had been funded by a Montreal-based proprietary trading firm called Vigilant Futures (which has since changed its name to Vigilant Global.) In the early days, he said, Vigilant Futures and CEP News had even shared office space. Arvind Ramanathan, one of Vigilant’s two directors, and Marco Gomez, who ran CEP’s operations in the absence of the elusive Darren Corbett, had both worked together as traders at Refco before it collapsed amid scandal in 2005. When I phoned Ramanathan, he confirmed to me that Vigilant Futures had invested in Canadian Economic Press to help out his friend Marco, but that the venture hadn’t worked out and had had to close down.

Once I learned that a trading company had been behind Canadian Economic Press, I was forced to reconsider a theory I’d initially rejected about CEP’s and the other news agencies’ whole raison d’être, namely that their main goal was to gain access to secure government briefing sessions all over the world. These “lock-ups”, as they’re known, are where government agencies regularly release key financial indicators to reporters, who in turn disseminate the data to the public at what is supposed to be exactly the same time. When the information is surprising — better than expected unemployment figures, for example, or an unexpected hike in interest rates — financial markets react. The advantage and profits go to the traders who get their first.

Given that I had reported from lock-ups, as a journalist for Reuters, one of the big three financial news companies, I was convinced there was no way anyone could systematically leak sensitive economic information to traders. On the rare occasions that I’d seen someone unintentionally break a lock-up embargo, irate officials from the central bank or finance minister’s office were on the phone within minutes. Journalists worried about losing their jobs over an accidental leak while intentional leaking could result in criminal charges. Regulators were constantly on the lookout for suspicious trading patterns ahead of a key economic data releases and ready to pounce if they saw any signs of insider trading.

What I’d failed to figure out, however, was that it wasn’t necessary to leak to have an advantage in lock-ups. I still pictured traders waiting by their screens, with fingers on buttons, and ready to pounce when Reuters (now Thomson Reuters), Bloomberg and Dow Jones all delivered their news and numbers at the appointed time. I didn’t understand that simultaneous no longer meant at the same minute or second and that so-called high frequency traders now worked in milli and microseconds. I didn’t appreciate that the new best way to do things was with so-called machine readable feeds that were algorithmically programmed to buy and sell automatically without the need for any microsecond-sapping human intervention. I didn’t realize that a trade could be carried out in less time than it took to blink an eye and that several of the news agencies in the lock-ups were using their own dedicated fibre optic lines to send data directly to their clients, whoever those clients were.

I wasn’t the only person who didn’t get this. Neither did the folks in charge of the lock-ups, most regulators, law enforcement agencies and the upstart news services’ competitors. As an anonymous source would later succinctly explain it: “(The new news agencies) were light years ahead technology wise over DJ, Reuters, Bloomberg, AP, etc. They built highly optimized networks to transfer this data through ultra low latency switches and lines that the other guys never thought of. They also were optimized to this single rifle shot of data through a network where the big legacy guys were using systems/networks optimized for throughput and continuously publishing hundreds or thousands of stories simultaneously and continuously.”

Keeping all this in mind, along with the fact that the stated purpose of government lock-ups is to inform the public and not to provide an infrastructure for high frequency traders, the obvious next question became why no one had kicked the wonky news agencies to the curb? But when I tried to discuss this issue with those responsible for the lock-ups, they proved almost as secretive and loath to talk about their business as the HFTs had been about theirs.

There had been complaints about NTKN and its relationship to specific Chicago traders, some of which are documented on the internet, since its arrival on the scene in 2005 yet it still managed to keep its much coveted seat in the U.S. Department of Labor lock-ups . And though CEP News had its access to Office of National Statistics lock-ups in England — where it was briefly allowed entry, thanks to a newly hired staffer who already had valid press credentials — revoked, it easily gained admission to lock-ups in Ottawa and Frankfurt. Econolive, yet another strange news agency which sprung up at about the same time Canadian Economic Press went under in 2009, was welcomed into lock-ups in Ottawa, Washington, and, for a short while, London. Run by an Israeli American named Yakov (Yankey) Mermelstein, who had no background in the news business and a history of active participation in web trading forums, it also used the name Empire News and had a corporate address in Jerusalem.

I was starting to think that instead of an indecipherable investigative report on incompetence in the administration of G-7 lock-ups, I might be better off writing a sitcom script. The pilot could focus on an email I’d just received from the FBI — which did not from an fbi.gov address but rather from Concerned Citizen at forbrocklehurst@gmail.com. “Ms. Brocklehurst,” read the email, “Any chance you’d be willing to talk by phone about your posting Monday regarding the visitors to your site? If so, could you send me a number where I could reach you this morning?”

The blog posting in question showed that officials at the U.S. Securities and Exchange Commission were searching my website for information on the news agencies and their owners. Concerned Citizen, who had a thick southern accent and identified himself as a United States special agent named Bob, asked if I’d be willing to take my post down as it could interfere with his investigation . He said someone at the SEC had erred in not using secure computers for their research and buttered me up by telling me how he and his colleagues checked out my website regularly. This was a very big story, he said, hinting that there might be a scoop or two in my future if did him this favour, which I did indeed do.

While I had initial suspicions that Agent Concerned Citizen might be a hoaxer, he wasn’t. The FBI turned out to be even worse at secure surfing than SEC employees and somehow managed to leave information stored in their C-drive files, including employees’ first names, on my web traffic monitoring program. So when Agent Concerned Citizen failed to return my emails, I did what I should have done all along and published the evidence showing the sorry state of FBI computers.

Only last year did I finally learn from a series of Wall Street Journal articles how the FBI had spent years investigating what it deemed to be suspicious activity in lock-ups. In 2011, it had installed a hidden camera in the room where the U.S. Labor Department holds its media briefing sessions, the Journal reported. And that same year, the SEC had also subpoenaed computer hard drives used by Need To Know News’s reporters.

None of this led to any criminal charges being laid although the suspicions did eventually cause the Department of Labor to commission the dramatically named Clean Sweep Red Team Report, from Sandia National Laboratories. As a result of this investigation, the DOL announced in spring of 2012 that it would overhaul procedures for its lock-ups and that all media participants would have to reapply for permission to attend. In May, it said three previously accredited news agencies would no longer be eligible to file from lock-ups because they were not considered to be “primarily journalistic enterprises” that disseminate original news to a “broad public audience.” Those given the boot were NTKN, the Bond Buyer and RTT News, which had briefly employed CEP’s old marketing director. The agencies did, however, remain eligible to participate in a variety of other government lock-ups.

At about the same time as Clean Sweep Red, Statistics Canada proposed changes that would slow things down in the lock-ups it oversaw. It announced that it would delay its releases to the public by as much as 16 seconds as part of a new data-loading process onto its website. Given that 16 seconds is a veritable lifetime in a world where milliseconds can mean millions of dollars of profits, there was immediate pushback.

Since the arrival of the strange news agencies, the big three financial data providers had caught up and were now also offering clients the direct machine readable feeds that used to be exclusive to their smaller rivals. According to Thomson Reuters, “strenuous representations” were made to both StatsCan and then Industry Minister Christian Paradis, arguing that such a change could cause chaos on financial markets. Within two days Statscan had backed down and agreed to hold consultations. Although spokeswoman Gabrielle Beaudoin said in October 2012 that a decision would be forthcoming very soon, the situation remains unresolved to this day.

Without understanding how lock-ups have evolved to become a crucial part of HFT infrastructure, it’s difficult to appreciate how complex it is to make any changes to them. When there was a fuss last year over possible leaks from a U.S. Federal Reserve lock-up, Google’s executive chairman Eric Schmidt opined that the institution of lock-ups was obsolete and that it made much more sense just to release data on the web. But take away the lock-up with all the special fibre optic lines — and, more recently, microwave networks — leading out of it and the financial industry would be back to looking at numbers on a screen and pushing old fashioned buttons.

Michael Lewis’s Flash Boys ends in the wilds of Pennsylvania at the foot of a microwave tower, the latest frontier in the race for speed. It was not unfamiliar territory to me as I had learned about how microwave networks were 30% faster than the most sophisticated landlines last summer when it came to my attention that Vigilant Global, now owned by the Chicago trading firm DRW, had applied for permits to build wireless networks in both North America and Europe.

In England, Vigilant had stated in a position paper, that the failure to create such a network could result in job losses in London’s important financial industry. But such arguments failed to convince city councillours in Castle Point, Essex who voted against the Montreal company’s request to put two satellite dishes atop a local water tower. “I don’t understand why every two or three months we are getting applications for more equipment on this building, “ Norman Smith, a Tory councillor , told the local newspaper.“I am happy to approve applications to replace existing, tired equipment but not more. Enough is enough.”

Postscript: I am working to add links to this story, but wanted to get it out asap.